Guides + Resources

Guides for Getting Started

Since the first lot of certified B Corporations was unveiled in 2007, this cohort of businesses has matured to consist of 150 industries—including the financial sector. Today there is a growing number of financial firms across the globe—including banks, asset management, and venture capital firms—that are B Corps, which presents a new opportunity for merging capital with purpose

We are thrilled to unveil our new series from The Conscious Investor where we invite you to join us as we talk with thought leaders about impact investing, values alignment, and social change. For our premier segment, Getting Started in Impact Investing: A Webinar with Kim Griffin of Toniic, we unpacked how to merge money with meaning, what makes for successful impact investments, and how Toniic is encouraging a global conversation around mission-driven endeavors.

As critical as due diligence is for traditional investing, Eva Yazhari believes that impact investors have an even higher duty to conduct a comprehensive investigation of a company.

Corporate policies and company behavior have a direct link to amplifying or fixing societal issues. The way employees are treated in the workplace much informs their lives outside. The onus is not just on the leaders at these institutions, but on the investors to take notice and speak up.

United by transparency, ethics, and a positive outlook, these are the people and organizations working to elucidate impact investing today. They are changing the culture, shifting the paradigm, and inspiring the next generation of socially responsible investors.

Within the world of investing that gives credence to ESG factors, there are some terminologies and styles that are often used interchangeably. One common question we come across pertains to confusion between ESG and impact investing.

Where we place our capital has the potential to yield negative outcomes or positive outcomes—or both. We need to continue to change the way we look at money and shift our focus to it being a driver of positive social, ethical, and environmental change.

All Guides + Resources

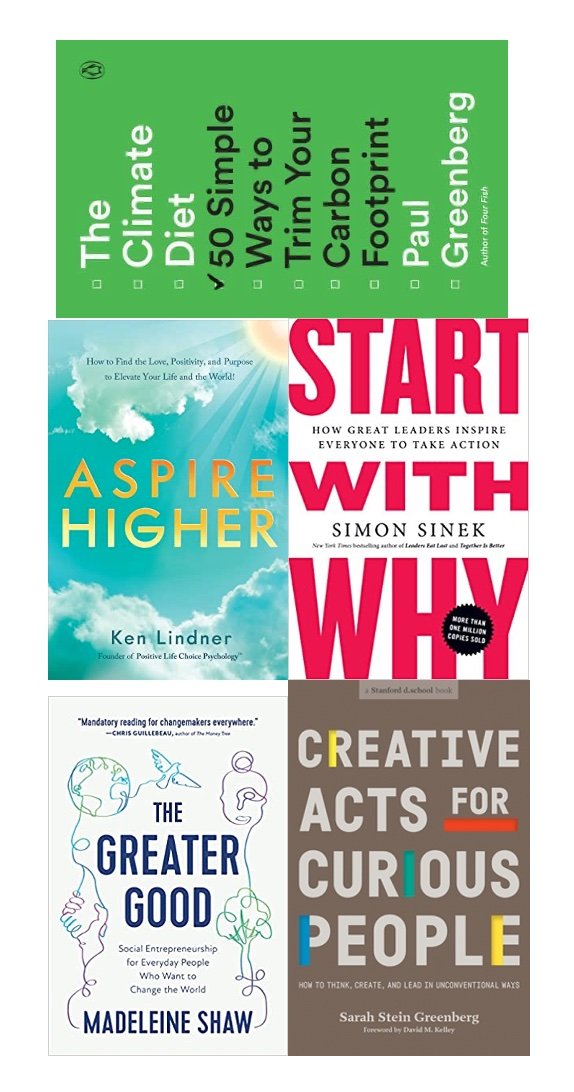

At the top of 2022, our latest shortlist of new books that provide a pathway to a better world.

The noteworthy articles, events, programs, movements, and other endeavors fueling us this month.

Our shortlist of new books that provide resources and guides for breaking down current states of systemic discrimination, homing in on your values, and honoring your integrity.

In her new book The Good Your Money Can Do, Eva Yazhari introduces her concept of impact investing and shares the story of her own mindset shift toward investing with awareness.

The new report ‘Making the Case for Investing in Menstrual Health and Hygiene’ offers guidance on where to focus funding for strategic and effective programming for this critical female health issue.

In this new collection of essays, Sir Ronald Cohen, Laura Callanan, and other creatives from around the globe illustrate the need and opportunity for impact investment to sustain and grow the creative economy.

Successful impact investing in African art and culture requires an appreciation of the local context and the relative value of different types of cultural assets, write Judith Aidoo.

Our team has selected noteworthy articles, events, programs, movements, and other endeavors to experience this month.

We rounded up some of our greatest takeaways from the five-day virtual summit. Our thanks to the amazing SOCAP team for producing such a compelling global event.

Jessica Droste Yagan, CEO and managing partner of Impact Engine, explains the innovative 5P framework and how it can offers people a new vocabulary to better understand the potential of impact investing—and any new purposeful venture.

We’ve been galvanized by leaders who break the norms, history lessons that offer modern lessons, and the idea that democracy is something we all need to take part in.

Since the first lot of certified B Corporations was unveiled in 2007, this cohort of businesses has matured to consist of 150 industries—including the financial sector. Today there is a growing number of financial firms across the globe—including banks, asset management, and venture capital firms—that are B Corps, which presents a new opportunity for merging capital with purpose

In 2015, the United Nations devised a set of objectives that speak to the most extreme issues facing humanity. This grand vision recognizes that ending poverty must go hand-in-hand with strategies that build economic growth and address a range of social and environmental needs—all by the year 2030.

Much like impact investing, being a more conscious consumer is about aligning our money with our values. There is no one shape or size, and there are endless ways to go about doing it.

We are thrilled to unveil our new series from The Conscious Investor where we invite you to join us as we talk with thought leaders about impact investing, values alignment, and social change. For our premier segment, Getting Started in Impact Investing: A Webinar with Kim Griffin of Toniic, we unpacked how to merge money with meaning, what makes for successful impact investments, and how Toniic is encouraging a global conversation around mission-driven endeavors.

As critical as due diligence is for traditional investing, Eva Yazhari believes that impact investors have an even higher duty to conduct a comprehensive investigation of a company.

Corporate policies and company behavior have a direct link to amplifying or fixing societal issues. The way employees are treated in the workplace much informs their lives outside. The onus is not just on the leaders at these institutions, but on the investors to take notice and speak up.

Think of a socially-driven changemaker you admire and chances are that they opted out of the traditional route and forged their own path. That is the theme of these four books, each of which touts unique viewpoints and approaches that put people and planet first.

United by transparency, ethics, and a positive outlook, these are the people and organizations working to elucidate impact investing today. They are changing the culture, shifting the paradigm, and inspiring the next generation of socially responsible investors.

Within the world of investing that gives credence to ESG factors, there are some terminologies and styles that are often used interchangeably. One common question we come across pertains to confusion between ESG and impact investing.

At The Conscious Investor, we discover works every day that inspire us. We seek these stories out—and we are endlessly encouraged by them. Here’s what has grabbed our attention as of late.

Do commonalities between successful CEOs exist or is leadership the calculated result of bold intelligence, strategic ambition, and a generous dose of luck?

These books deliver unique messages about the collective positive impact happening in the world today, all thanks to motivated individuals and companies. Each page and perspective is a push to transcend the normal and fight for more compassion, equality, and justice—and for a healthier planet.

Where we place our capital has the potential to yield negative outcomes or positive outcomes—or both. We need to continue to change the way we look at money and shift our focus to it being a driver of positive social, ethical, and environmental change.

Often the most challenging aspect of impact investing is narrowing our focus. Where do we want to make an impact? What social, ethical, or environmental causes weigh on our hearts and minds? Marrying money with meaning calls us to look within ourselves and discover what is truly paramount.

The traditional goals of investing—to gain a financial return—are evolving. More and more people want to see their money create positive change in the world, which is why impact investing is on the rise.

Jessica Droste Yagan, CEO and managing partner of Impact Engine, explains the innovative 5P framework and how it can offers people a new vocabulary to better understand the potential of impact investing—and any new purposeful venture.